Who Is Entitled to Death Benefits in Social Security?

Social Security benefits are a lifeline for many individuals and families both when illness or injury strikes or when people reach their elder years and are unable to continue working for a living. But Social Security Disability benefits are essential for families who suffer the tragic death of a loved one on whom they depended. The loss is deeply painful emotionally. But the loss of the person’s financial support is also a loss that threatens to undermine a survivor’s living circumstances.

In Georgia and throughout the nation, The Kenner Law Firm has been helping survivors understand and obtain the Social Security benefits they deserve for more than 30 years. If you think you might be entitled to receive Social Security benefit payments, Keener Law is ready to help you.

Eligibility for Social Security Survivor Benefits

Social Security retirement funding is paid by workers’ weekly payroll contributions and self-employment taxes. The purpose of the program is to provide workers and their spouses and certain other dependent family members with financial support during periods of long-term disability or when they reach full retirement age.

Despite every worker’s weekly contribution to Social Security funding, few people have a grasp of who is eligible to receive Social Security benefits based on the working history of a family member who dies. Although some people use the term “death benefits,” the payments are actually “survivor benefits.”

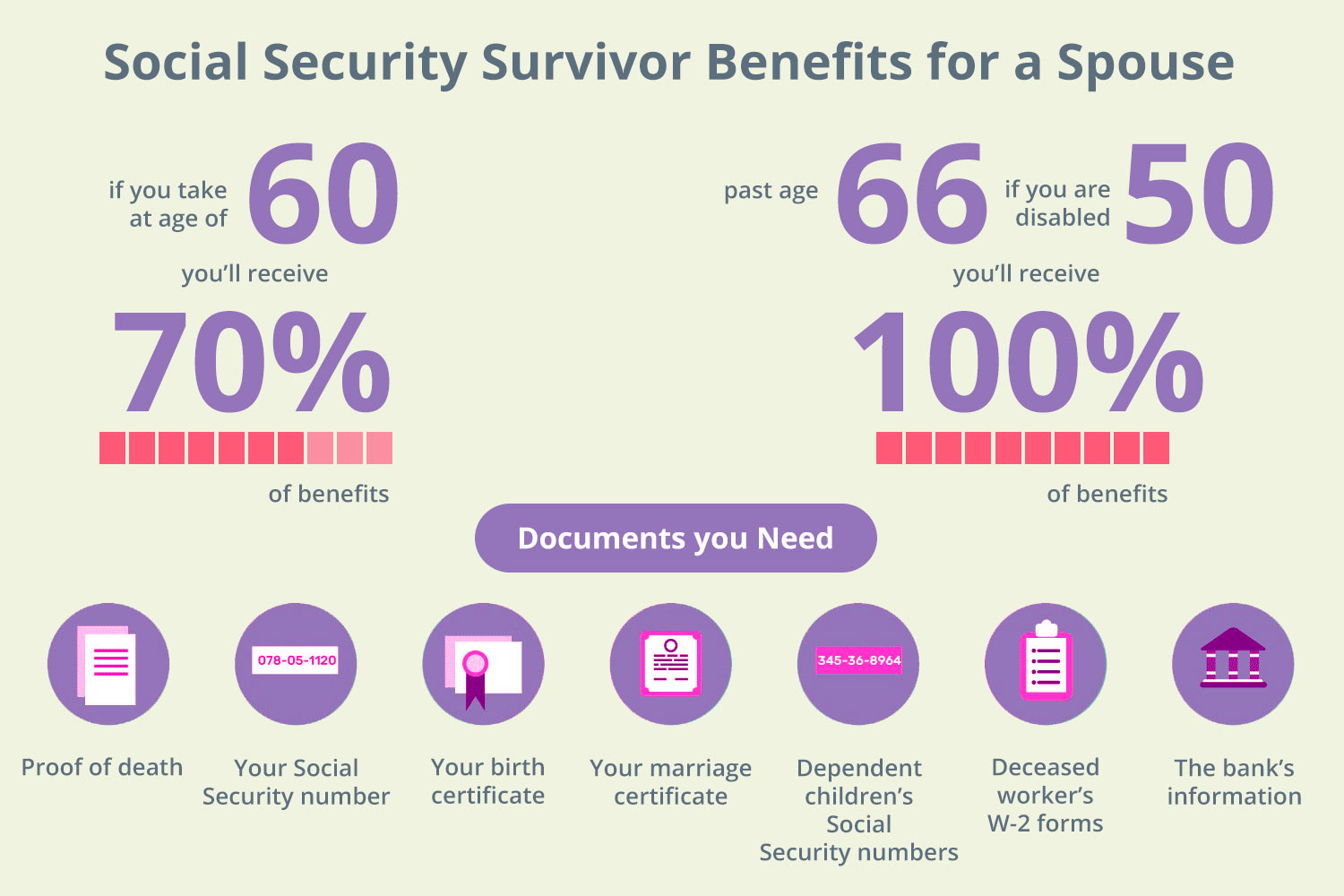

Spousal Survivor Benefits

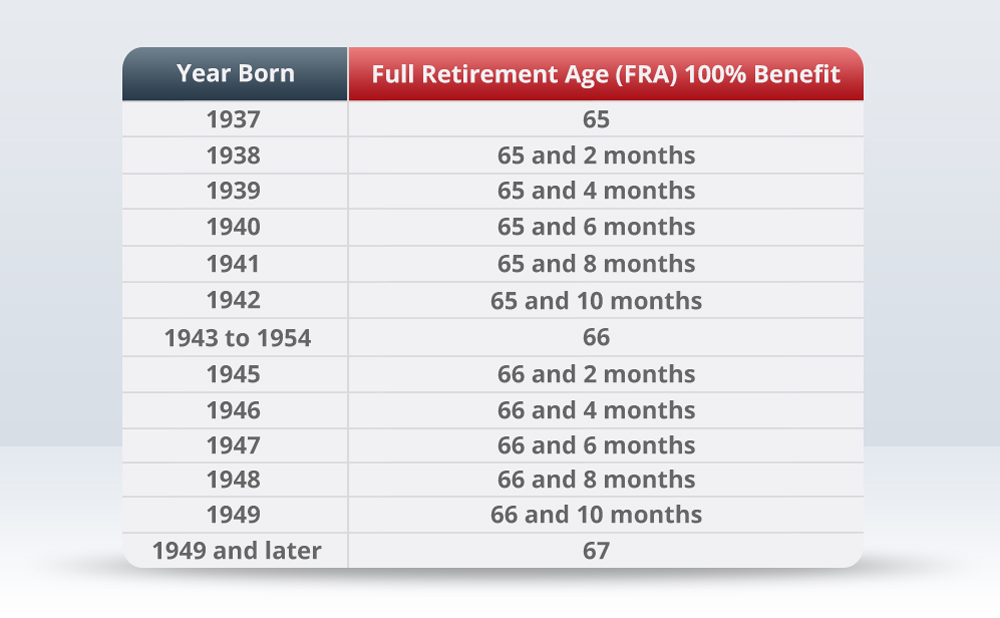

The spouse of a deceased worker is eligible to receive up to 100 % of their late spouse’s Social Security benefit if the surviving spouse has reached their full retirement age, their FRA. Just as the worker themselves could not receive 100 % of their full benefit until they reached their own FRA, the surviving spouse’s share is also limited by age.

Surviving Spouse Not Yet at Full Retirement Age

A surviving spouse between the age of 60 and their full retirement age can receive a large but limited percentage of what their deceased spouse would have received had they lived to their full retirement age. The percentage they would receive depends on their age. While a 60-year-old surviving spouse would receive 71 and ½ % of their late spouse’s full benefit amount, a surviving spouse who filed for survivor benefits at an older age would receive an incrementally higher percentage, between 72 % and 99 %.

Disabled Surviving Spouse

When the surviving spouse of a deceased worker is disabled, the age at which they can file for and obtain Social Security survivor benefits is lower. A disabled surviving spouse who is at 50 through 59 can receive 71 ½ percent of their deceased spouse’s full Social Security retirement benefit. If they were not disabled, they would not be eligible for survivor benefits until age 60.

Surviving Spouse Caring for Child Under 16

A surviving spouse at any age who is caring for a young child under the age of 16 can receive 75 % of their deceased spouse’s full benefit amount. When someone with young children loses their spouse, Social Security benefits are especially needed, and the surviving spouse’s age is not significant. In fact, those caring for children under 16 are likely to be younger.

Surviving Former Spouse

If your former spouse dies, you can receive Social Security payments equal to 100 % of your deceased former spouse’s benefits. Your former marriage must have lasted 10 years or longer and you may not be remarried before age 60. Both the decedent’s current spouse and former spouse will receive 100 % of the benefits. The former spouse’s receipt of benefits will not affect the amount paid to any other survivor.

Surviving Child Under Age 18 (or 19)

Children of a parent who died before the child reached age 18 are eligible to receive up to 75 % of their deceased parent’s full Social Security benefits. This age can be extended until the child’s 19th birthday if they are still enrolled in elementary or secondary school.

Disabled Child or Adult Whose Disability Began Before Age 22

Any child or adult whose disability began before age 22 is eligible for up to 75 % of their deceased parent’s Social Security if their late parent had already begun to collect their Social Security retirement or they were receiving Social Security Disability benefits. The age of the disabled child or adult will not affect their entitlement to the survivor benefits if the other conditions are satisfied, i.e., disabled before age 22 and their parent was receiving Social Security.

Surviving Dependent Parents of a Deceased Worker

If a deceased worker had one or two dependent parents at the time of their death, the dependent parents are eligible to receive a large portion of their late child’s Social Security benefits. If there is only one dependent parent, they will receive 82 ½ % of their child’s benefits. If both parents are dependent, then each parent will receive 75 % of the decedent’s benefits.