How To Apply For Social Security Disability Benefits In Georgia

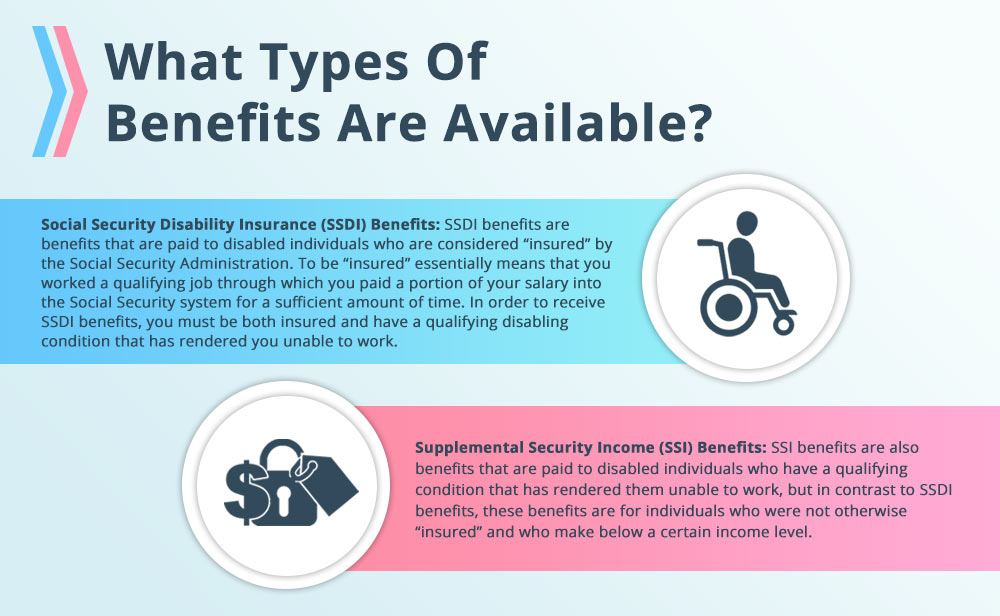

If you live in Georgia and are disabled by a medically determinable physical or mental impairment that limits your ability to work, you may be eligible for Social Security disability benefits. The Social Security Administration has two programs, Social Security Disability Insurance and Supplemental Security Income, that pay monthly benefits to people with disabilities expected to last for at least 12 months. Georgia does not have a state program paying short-term disability benefits as do only a handful of other states.

The process to apply for disability benefits through SSI or SSDI can be challenging. Fewer than one-third of the applications received by the Social Security Administration are approved during the initial determination process. That leaves more than two-thirds of people who may have valid claims for disability benefits to either give up or attempt to overturn the unfavorable decision through a complex appeal process.

What follows is information to familiarize you with the SSDI and SSI programs and the process you must go through to apply for disability benefits in Georgia. Read through it, and then contact a disability lawyer at the Keener Law Firm for answers to your questions and assistance with an application for benefits or with an appeal of an adverse determination of a claim that you previously filed.

Overview Of the SSI And SSDI Programs

The SSDI program requires that you worked at jobs or through self-employment and paid Social Security taxes on the earnings to be eligible to file for disability benefits. For 2023, you receive one work credit for each $1,640 of income you receive through a job or self-employment up to a maximum of four credits per year. The amount of income needed to acquire a work credit changes from year to year, so check with an SSDI lawyer for additional information.

The number of credits needed to meet the work required to be eligible for SSDI depends on how old you are when you first become disabled. You generally need 40 credits to qualify with at least 20 of them earned within 10 years of the onset of the disability. Workers who are disabled at a younger age do not require as many work credits.

For example, if you become disabled before 24 years of age, you need six work credits earned during the three years prior to the onset of the disability. In contrast, if your disability begins when you are 29 years old, you must have 16 credits earned within the prior eight years.

If you meet the work requirement for SSDI, you must be disabled within the definition that Social Security uses to evaluate your claim. A qualifying disability must meet all of the following criteria:

- You must be unable to engage in substantial gainful activity as a result of a medically determinable physical or mental impairment.

- Your impairment or impairments must last or be expected to last for at least 12 months or be expected to result in death.

- You must be unable to engage in work you previously did, and your medical condition must prevent you from adjusting to do other types of available work.

The number of work credits that you have do not determine how much you receive each month in benefits through SSDI. Lifetime earnings are used to calculate your monthly benefit.

If you do not have a work record that allows you to qualify for SSDI, an option may be the SSI program that pays benefits when a disability or blindness prevents you from working. As a need-based program, SSI eligibility imposes limits on the income and resources that you may have available to you to acquire such essential items as food, shelter and clothing.

The maximum federal benefit payable to individuals whose applications for SSI are approved is For 2023, you receive one work credit for each $1,640. Annual cost-of-living adjustments can increase the monthly federal benefit. Some states, including Georgia, supplement the monthly federal SSI benefit for some applicants. An SSI lawyer at Keener Law can help you to determine the benefits that you are entitled to receive.

How To Apply For Disability In Georgia

Applications for SSI and SSDI disability benefits may be filed online, over the phone, or in person at a Social Security Administration field office in Georgia. The application is initially reviewed by the SSA to determine that you meet the work-record requirement for SSDI and do not exceed the income and resource restrictions for SSI before it is forwarded to the disability determination service. The DDS is a state agency in Georgia that obtains and reviews your medical records to determine whether you are disabled and eligible for SSI or SSDI.

Contact a Keener Law disability lawyer for help

An SSD lawyer at the Keener Law Firm can assist you with the application process or represent you in the appeal process to challenge a denial or reduction of disability benefits. Learn more about how to apply for disability by contacting us for a free consultation.

Send Us a Message

Recent Posts

- How Long Does It Take to Win a Disability Appeal in Georgia?

- What Mistakes Can Delay Your Disability Benefit Approval in Georgia?

- How Disability Hearings Work in Georgia: Process & Legal Tips

- What Medical Evidence Do You Need for a Disability Claim?

- Top Reasons Disability Claims Get Denied in Georgia