How Much Social Security Disability Benefits Will I Get at Age 65?

Those who are struggling with a long-term, severe disability may depend upon their Social Security disability benefits to support themselves and their families. Understandably, then, it can be worrisome to think of losing those benefits or having them reduced in any way. As a result, many people wonder whether, when they reach 65 and qualify for Social Security retirement benefits, they will automatically lose their disability benefits. Let’s take a closer look at the law together.

What Type of Disability Benefits Do You Receive?

Prior to understanding how aging might affect your ongoing entitlement to benefits, it’s important to keep in mind that there are two types of Social Security disability benefits:

- Social Security Disability Insurance (SSDI) Benefits: SSDI benefits are those paid to “insured” individuals who have a qualifying medical disability that has rendered them unable to work for at least one calendar year or more. To be “insured” generally means that the person worked a qualifying job for a sufficient length of time through which he or she paid taxes into the Social Security system.

- Supplemental Security Income (SSI) Benefits: As with SSDI benefits, those who receive SSI benefits must have a medical disability that has caused them to be unable to work for at least a year or more. Unlike the case with SSDI benefits, however, those who receive SSI benefits do have to be “insured”. Instead, those who receive SSI benefits must have income and resources below a certain level to qualify.

The two types of benefits will be affected differently by aging and understanding the distinction between the two can help with financial planning for the future.

How Are Your Benefits Affected by Age?

If you receive SSI benefits, reaching the age of 65 will generally not affect your benefits, as SSI is funded through the United States Treasury, and not by Social Security taxes. As a result, if your income and resources remain the same and do not increase beyond the threshold established by law, there will be no change in your SSI benefits simply because you reached retirement age.

If you do not receive SSI benefits, but you receive SSDI benefits instead, they will ultimately convert to Social Security retirement benefits when you reach full retirement age. There will typically not be a pause or an adjustment in benefits – the transition will simply be made from one type of benefit to the other. Those who have been transitioned from one type of benefit to the other will not notice many changes – but generally any sort of periodic “reviews” to determine continued eligibility for disability benefits will cease once the transition has been made.

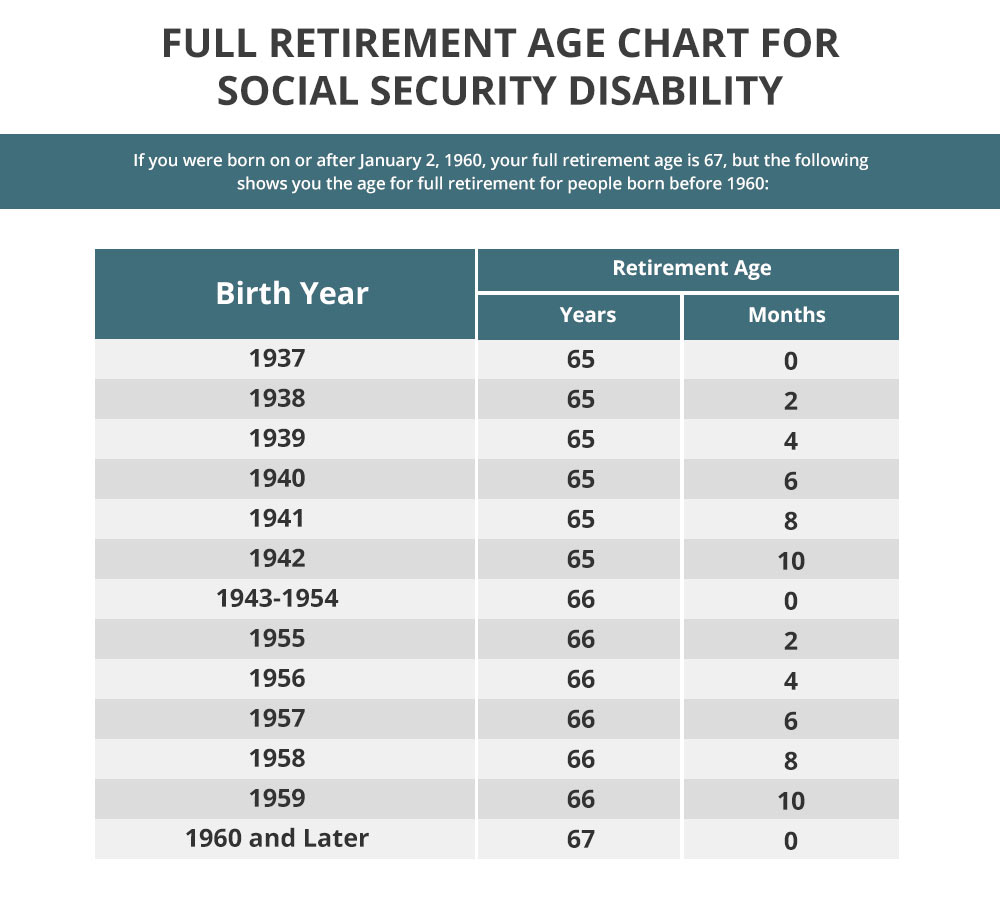

For those who will cease receiving SSDI benefits and begin receiving retirement benefits from the Social Security Administration instead, it’s important to understand that what constitutes “full retirement age” will vary depending upon the year you were born. A person born in 1955 will reach full-retirement age at 66 years and 2 months. Thereafter, what is considered “full” retirement age will increase by increments of months, until reaching the group of individuals born in 1960, or later, who must wait until they are 67 years of age to begin collecting their full benefit amount.

What if I Take Early Retirement Benefits?

This is another question that’s often asked for those approaching age 65, or for those born in 1960 or later who have reached age 65 but don’t yet qualify for full retirement. The truth of the matter is that this issue can become complicated, and those who choose to collect early retirement benefits around the age of 62 may unintentionally reduce the amount that they would have otherwise received had they waited until full retirement age.

In part, this is because those who choose to collect early retirement receive a lesser amount in exchange for not waiting until full retirement age. For a variety of reasons, it may be a better option to collect SSDI benefits until the full retirement age is reached. Consulting with an attorney on this, and all other legal matters surrounding disability benefits is always advised. At Keener Law, we’re here for you.

How Do You Qualify For Disability In Georgia?

To qualify for disability benefits in Georgia, you must meet the Social Security Administration’s (SSA) definition of disability, which requires that you have a severe medical condition that is expected to last at least one year or result in death, and that prevents you from performing any substantial gainful activity.

To determine if you meet the SSA’s definition of disability, the agency will consider the following factors:

- Medical evidence: You must provide medical evidence of your condition, including diagnosis, treatment history, and medical test results.

- The severity of your condition: The SSA will evaluate the severity of your condition and determine how it limits your ability to work and perform daily activities.

- Ability to work: The SSA will determine whether you are able to perform any of your past relevant work or any other work that exists in significant numbers in the national economy.

- Duration of your condition: The SSA will consider whether your condition is expected to last for at least one year or result in death.

To apply for disability benefits in Georgia, you can complete an application online at the SSA’s website, visit your local SSA office, or call the SSA at 1-800-772-1213 to request an application by mail. It’s recommended that you provide as much medical evidence as possible when applying to increase your chances of being approved for benefits.

Call Keener Law Today

At Keener Law, we understand every aspect of Social Security law. Our knowledgeable and experienced team will be able to guide you through the process of seeking benefits with the expert skill and compassionate guidance you deserve. Every step of the way, we’ll pursue the best legal strategies on your behalf. We’ll fight for you as you seek to move forward toward a better and brighter chapter ahead. If you’re ready to get started, we’re here to help – and there’s no day like today to get started. Give us a call. We look forward to speaking with you soon.