How To File for Social Security Disability Benefits in Georgia

If illness or injury limits your ability to earn a living, help may be available through the Social Security Administration. Social Security Disability Insurance and Supplemental Security Income are two disability programs that pay monthly benefits and offer coverage for medical expenses, but the application process can be difficult.

When you file for disability in Georgia through SSDI and SSI, fewer than one-third of your applications are approved at the initial determination stage. The other two-thirds of applicants either give up or must go through the process to appeal their denial of benefits, but you can increase your chance of a successful outcome by relying on the knowledge and skill of a disability lawyer at the Keener Law Firm.

The following information covers some of the essential things you need to know to get it right without making mistakes or omitting important details when you file for disability in Georgia through the Social Security Administration. As you read on, remember that a disability lawyer is available to answer any questions you may have about the application process.

How To File for Disability In Georgia

The process to file for disability starts with an application and an Adult Disability Report. There are three ways to choose from in order to fill out and file the two documents:

- During an in-person interview at a local Social Security field office.

- By telephone in a call with a Social Security representative.

- Online where you can complete and file both the report and the application.

If you prefer, you can start the process online, and complete it during an in-person interview at a Social Security office or over the phone. You need to contact Social Security in advance to schedule either an in-person interview or a telephone interview.

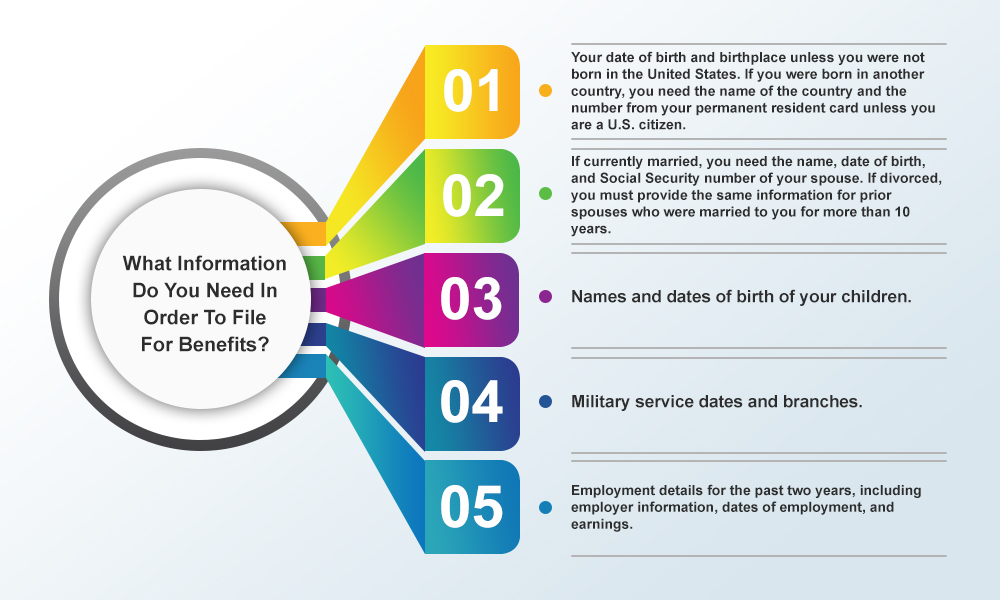

What Information Do You Need In Order To File For Benefits?

You can speed up the time it takes to complete the application and Adult Disability report by gathering information in advance, including:

- Your date of birth and birthplace unless you were not born in the United States. If you were born in another country, you need the name of the country and the number from your permanent resident card unless you are a U.S. citizen.

- If currently married, you need the name, date of birth, and Social Security number of your spouse. If divorced, you must provide the same information for prior spouses who were married to you for more than 10 years.

- Names and dates of birth of your children.

- Military service dates and branches.

- Employment details for the past two years, including employer information, dates of employment, and earnings.

You should also compile a list of all medical conditions. Include the names and contact information of all doctors and other healthcare professionals that provided treatment and other services for your medical condition. Make note of the date and location of diagnostic tests or imaging, including MRIs and CT scans.

If you are applying for SSI, be prepared to provide information about all income sources and the amount of resources, including bank account balances and other assets, for yourself and, if married, for your spouse. The application for SSI also requests information about your current living arrangements, including other people living in the household and the overall household expenses.

Applications can be denied or unnecessarily delayed by mistakes or by failing to provide information. Getting your documents and information together in advance not only saves time but also may result in a more complete and accurate application.

Proving That You Have a Qualifying Disability

In order to qualify for disability benefits through SSI and SSDI, you must be disabled. That may seem obvious, but the Social Security Administration uses a specific definition you need to meet for your application to be approved.

According to federal regulations, you are disabled if you cannot perform a substantial gainful activity because of a medically determinable physical or mental health impairment that has lasted or is expected to last for at least 12 months or is expected to result in death. The substantial activity involves activities normally associated with work, including walking, lifting, sitting, and an ability to remember and follow directions.

Social Security uses earnings to determine whether a substantial activity is gainful. If you work and have monthly earnings in excess of $1,470 in 2023 you are engaging in substantial gainful activity and are not disabled according to the federal definition. You can earn up to $2,460 a month if your claim for disability benefits is based on blindness.

Get Help to File for Disability

The monthly benefits from Social Security disability can change your life when injuries or an illness prevent you from working. When there is so much at stake, doesn’t it make sense to at least talk to a disability lawyer at the Keener Law Firm and get advice about how to file for disability in Georgia or how to appeal a denial of a claim that you previously submitted? Contact us now for a free consultation.